Latin America is a Hot Market for Investable Climate Solutions

After leading a cleantech investing network in the U.S. with $10B of combined capital from leading climate VCs, family offices, and foundations, and supporting many early-stage climate founders by matching them with these investors, I saw the climate investing field take-off within the last two years. A welcome advance after decades of being under-leveraged and ignored. But I found an obvious and much talked about gap in diversity and global geographic representation in the climate tech space — both at the leadership of funds, LPs, and founders receiving investment. This is a gap I am passionate about resolving. Now I am using my connections to be a bridge to resources for exceptional climate founders from every country.

Last summer at NEXUS’ Global Summit in New York I met Andres Baehr, an Oxford MBA, former managing director of a corporate climate fund, and professor of VC at a leading university in Chile, who has this same goal in mind — expanding early-stage climate funding opportunities throughout Latin America, a region that is exploding in investment opportunities.

Since July 2022 I have been nomadically traveling, consulting, having delicious meal-meetings with investors, attending impact investing conferences, hiking in beautiful parks, and asking a lot of questions throughout Latin America. So far, I have lived in various parts of Colombia, Mexico, Argentina, and Chile, seeking climate solutions and learning first-hand about the state of early-stage climate tech funding in this incredibly important and fast-growing market. Here are some of the things I have learned.

Short Summary: Climate solutions, talent, and entrepreneurship are proliferating in Latin America, but entrepreneurs need more local, early-stage support, particularly at the seed stage (~$1–5M rounds). Latin America is the fastest growing region for VC, but climate VC in the region is nascent. We need to break down barriers so that entrepreneurs from every country and ethnic background can help solve climate change, and Latin America is ripe with 500+ early-stage climate tech founders currently seeking support.

Let’s start by looking at some general statistics on VC, Climate Tech and Climate Threats in Latin America –

The Latin American climate VC Landscape:

- Latin America is the world’s most rapidly growing region for the funding of startup companies. In 2021 VC invested a record $19.5 billion into startups based in Latin America, tripling previous years.[i] This was led largely by fintech, and many later stage $100M+ deals such as standout Rappi — a Colombian based food delivery service which received a $500M Series F.

- Only 1% of all climate tech investing is going to Latin America.[ii]

- Early-stage support for climate startups, particularly from local VC funds, is scarce at the post-incubator/accelerator stage.

- Fewer resources are focused on seed stage in Latin America, few to no funds are solely focused on climate tech at the seed stage.

- There are several large locally operated impact funds, corporate funds, and several international VC funds who carve out a few portfolio positions on sustainability in Latin America, with most of them focused on sustainable agriculture and Series A, or beyond.

Climate threats and opportunities in the region:

- Latin America needs to decarbonize, quickly, for the world to hit its climate goals.

- With a population of 670M (twice the U.S.) the region is responsible for 8% of global greenhouse gas emissions. That is equivalent to the same (8%) proportion of the global population. For comparison, the U.S. is responsible for over 11% of global emissions but represents 4.25% of global population. If Latin America’s use of fossil fuels grew similarly to China’s, the E.U., or the U.S., the world will not reach emission targets to stay at 2 degrees Celsius of warming or less.

- Close to 6 million people could fall into extreme poverty in Latin America due to climate change.[iii] More than US$10B would be lost in commercial activity.[iv]

- Latin America and the Caribbean have the highest waste per capita of emerging economies, and low recycling rates for most plastic resins.[v] Circular economy investing is a paramount issue.

- Decarbonization of Latin America has been shown to be technically feasible and will help with poverty alleviation from high energy costs.[vi]

- For the first time climate action is at the core of the political priorities of three new presidents: recently elected Lula Da Silva in Brazil, Gustavo Petro in Colombia, and Gabriel Boric in Chile. The recent elections show that climate action is a winning platform with voters (and consumers) in Latin America with more policies and government resources expected to follow.

- There are over 27 unicorns from Lat Am, creating a surge of new wealth and potential LPs — similar to the U.S. many are looking at putting their resources and talent toward something meaningful like climate solutions.

- There are over 500 startups working in the climate tech space in Latin America including: circular economy, ocean health, green mobility, renewable energy, and advanced materials.[vii]

Some Recent Climate Unicorns and Big Climate Raises for Latin America:

A 2023 map of dozens of Latin American climate tech (Seed to Unicorn) startups is available here.

Some Personal Observations:

- Liquidity for investments in Latin America can often happen in U.S. dollars, many companies headquartered and operated here are incorporated in Delaware, or Europe. Most CEOs speak perfect English and many graduated from top MBA programs in the U.S.

- More than half (55%) of all U.S. unicorns are founded by immigrants[xii], and after exits some are returning to invest, start companies, or live part-time or full-time in their native countries.

- An 18-year old’s fruit smoothie stand in Santa Marta, Colombia went out of business due to high energy prices, she couldn’t afford the energy costs to run the blender.

- Mexico City is becoming a hub for Latin American climate tech with numerous investors and startups flooding the region from the U.S. and other countries.

- We witnessed water quality and beach erosion in Santa Marta, plastic pollution near Barranquilla, smog in Mexico City and intermittent blackouts in many coastal towns in Mexico and Colombia which are impacting commerce, refrigeration, and quality of life.

- Indigenous communities play a much larger, and sometimes guaranteed, role in politics in certain countries — in Colombia they receive 2 out of 108 Senate seats and 1 out of 172 in the House while representing 4% of the population. The Mamo (leader) of the Kogi indigenous group in the mountains of Colombia believe the mountains are the ‘Heart of the World’ and they are the elders to protect it. The Kogi and other indigenous leaders have been a loud and consistent voice for climate solutions and protection of natural resources with vastly better political representation than indigenous groups in other countries.

- Awareness of climate is elevated and talked about in regular conversation, it is not often politically polarizing, or elitist, to openly discuss climate adaption or solutions. It’s welcomed.

- While sustainable agriculture has been a large investment field for Latin America, and much impact funding has been geared toward rural farming areas, cities are now major hubs for deep tech engineered climate solutions within circular economy, renewable energy, foodtech, software, and advanced materials. There are also a growing amount of LPs and family offices based in cities interested in climate — so far I visited the climate hubs of Mexico City, Bogota, Buenos Aires, and Santiago.

- Pre-Seed to Seed stage climate startups in Chile stated they do not have access to investors in the United States and Europe — as cold contacts are difficult and the distance makes the conference circuit or investor road show expensive and time consuming.

Suggestions on How to Grow Climate Tech in Latin America:

- Creation of more early-stage seed funds based in Latin America focused solely on climate tech.

- Additional government and University R&D funds to support climate tech IP development.

- Regional investor gatherings and cross border collaborations at climate hubs for startups, breaking down equity, and access barriers throughout Latin America.

- More corporations partnering with startups to cater to the desire for sustainable products and services in the large Latin American market (see the rapid growth of NotCo).

- International attention and collaboration with large climate VC funds.

- Education of VC firms, family offices, wealth managers, and high net worth individuals both in Latin America and abroad about the growth in climate startups in Latin America.

Thanks for reading. If you have suggestions on reports, connections with founders or investors, or notes about climate-tech investing in Latin America, please reach out: [email protected]

Matt Mulrennan is a Partner with Savia Ventures a seed fund to scale technologies in Latin America addressing climate change.

[i] PwC State of Climate Tech 2021.

[ii] Here’s What’s Driving Latin America’s Rank As The World’s Fastest-Growing Region For Venture Funding. Crunchbase. 2022.

[iii] A Roadmap for Climate Action in Latin America and the Caribbean 2021–2025. World Bank.

[iv] The Lat Am Tech Report 2022. Latitud.

[v] Reducing plastic pollution in Latin America: A HANDBOOK FOR ACTION. Circulate Capital Perspective. 2022.

[vi] Getting to Net Zero Emissions: Lessons From Latin America and the Caribbean. IDB. 2021

[vii] Savia Ventures identified over 700 companies in 8 countries working on climate solutions. 2023.

[viii] NotCo gets its horn following $235M round to expand plant-based food products. Crunchbase. 2022.

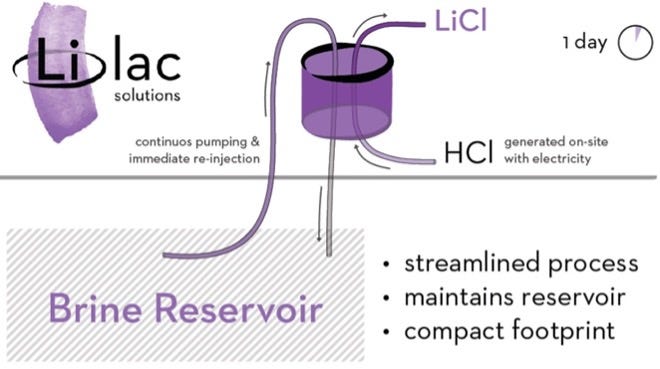

[ix] Strategic Investors Join Final Closing of Lilac Solutions’ $150 Million Series B for Lithium Extraction Technology.

[xi] Bright Announces Entry and Funding into Mexico’s Commercial and Industrial Solar Sector. 2022.

[xii] Most Billion-Dollar Startups In The U.S. Founded By Immigrants. Forbes. 2022.

Original Article at: https://medium.com/@matt.mulrennan/climate-tech-investors-look-south-a0e5ede6ae39